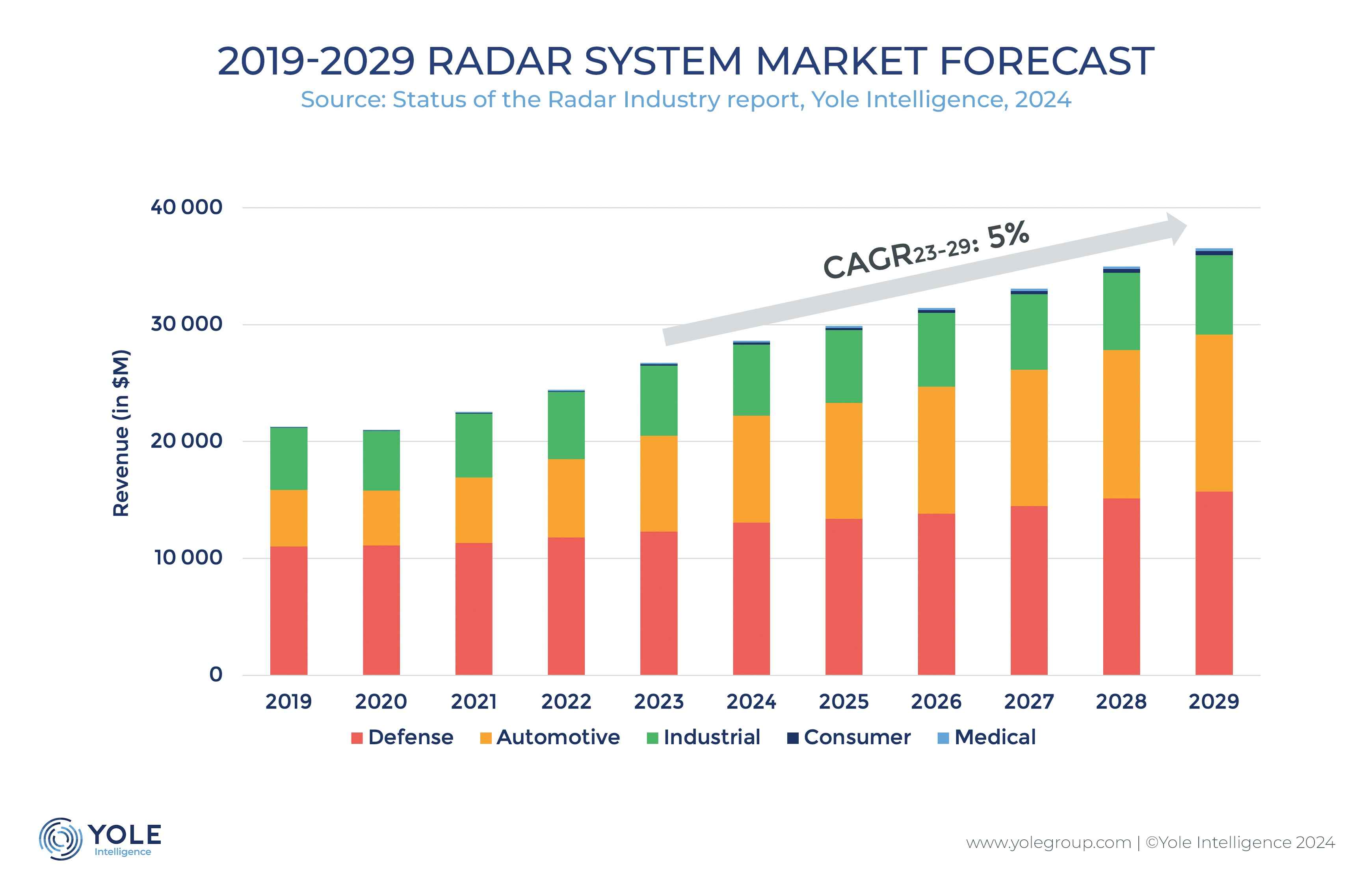

The automotive sector is expected to expand at an annual rate of 9%, from its 2023 value of $8.2 billion, it is forecasted to reach $13.5 billion by 2029.

The industrial sector, worth $6 billion in 2023, is projected to experience 2% CAGR to reach $6.8 billion by 2029.

The defence, security and aerospace sector will generate $12.3 billion in 2023, but its growth potential is limited, with an anticipated CAGR 23-29 of 4%, to reach US$15.7 billion in 2029.

in the consumer sector the approval by the FCC to allow 60GHz radars for mobile applications could propel the consumer radar market from $0.11 billion in 2023 to $0.35 billion in 2029.

The medical radar market is anticipated to witness a growth rate of 12% CAGR, from $0.12 billion in 2023 to $0.25 billion in 2029.

NXP, Infineon and TI are finding that growing competition is forcing the major chipmakers to reassess their strategies.

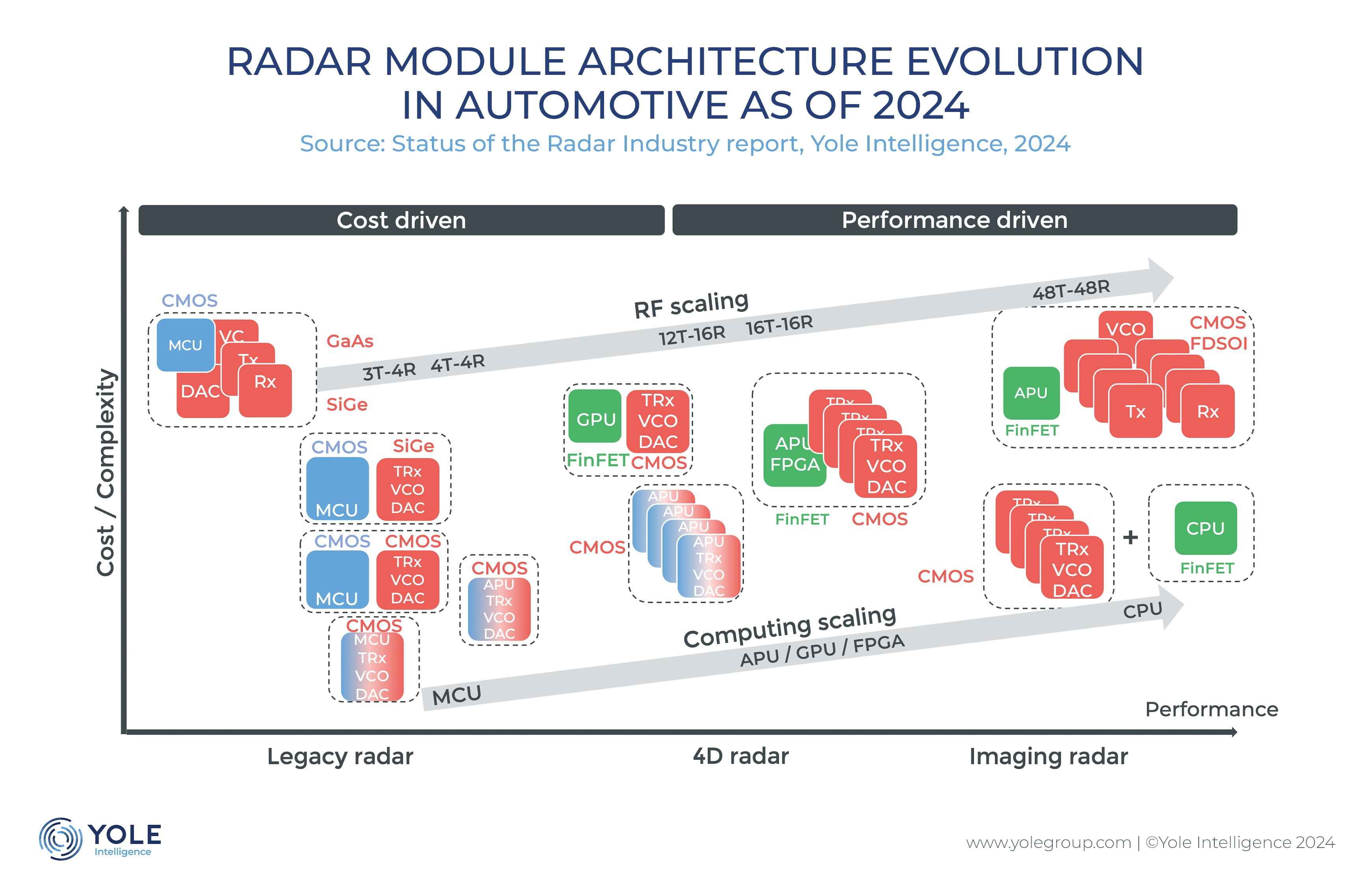

In automotive, the transition from GaAs to SiGe and now to CMOS radar modules has been revolutionary.

This transition has not only drastically reduced costs but also hints at a future where the price of standard 77GHz radar could drop as low as $30 by 2030.

However, the aspirations extend beyond cost reduction. Indeed, there’s a concerted effort to decrease the ASP of state-of-the-art 4D imaging radar to align with OEM s’ budget constraints.

The total EV DC charging system market will rise to $23 billion by 2029. While chargers between 50 and 150 kW dominated the market in 2023, there is a noticeable surge in demand for higher-power chargers, particularly those exceeding 150 kW. By 2029, the highest market value, estimated at $9.2 billion, will be attributed to very high-power chargers (150 kW ≤ x ≤ 350 kW).

“Despite strides in radar technology, current capabilities still lag behind the requirements for fully autonomous driving,” says Yole’s Raphaël da Silva, “module manufacturers are actively exploring diverse architectural approaches to bridge this disparity, aiming to expand the FOV and enhance angular resolution. This exploration involves strategies such as increasing RF channels, enhancing computing power, or a combination of both to achieve optimal results. It’s a dynamic landscape fostering innovation in pursuit of the ultimate goal of autonomous driving.”

Moreover, OEMs are leading a significant transition toward vehicle centralization, anticipated to be fully implemented between 2030 and 2035. This shift anticipates a future where more cost-effective, compact radars with advanced computational capabilities and superior system performance become the norm, paving the way for a truly autonomous driving experience.

Radar usage is also extending beyond its conventional applications, spurred by fresh FCC regulations and advancements in radar technology. This shift isn’t limited to established sectors, such as automotive, industrial, and defense; it’s also penetrating emerging fields like consumer electronics and healthcare.

Enhancements in precision, dimensions, affordability, and energy efficiency are aligning radar perfectly with these burgeoning markets, unlocking substantial prospects.

The radar module market is fiercely competitive, with numerous companies vying for market dominance. This competition spans various sectors, from the crowded automotive radar sector to specialized niches in industrial applications.

Consequently, module providers like Continental, Bosch, Aptiv, Smartmicro, InnosenT, are consistently lowering prices to maintain their competitiveness.

Recent partnerships among OEMs, Tier 1 suppliers, chipmakers, and antenna manufacturers are gaining traction, highlighting the strategic positioning of each participant.

While the module provider landscape is fragmented, the radar device market is dominated by a select few players,” explains Raphaël da Silva. “These established entities, known for their cross-industry supply, now face fresh competition from diverse players, including consumer electronics companies and OEMs, seeking to enhance their value proposition by developing proprietary chips.”

Recent technological advancements are poised to reshape the market, particularly with the integration of the transceiver and processing functionalities into single radar chips enabled by CMOS technology.

This innovation promises cost efficiencies, space optimisation, and supply chain streamlining for OEMs.

Additionally, in the automotive industry, companies are preparing for a transformative phase in E/E architecture, which will fundamentally redefine the roles of industry participants